This information is not legal, financial, or tax advice. This article is for informational and educational purposes only. Digital asset laws and company policies are complex and subject to change. You should consult with a qualified professional, such as an estate planning attorney, to address your specific situation.

When Mark’s father died, the family discovered $3,200 sitting in his PayPal account: money from selling tools online and payments from old freelance work. Getting access to those funds took eight months, required a lawyer, and cost more in legal fees than they recovered. “If Dad had just documented his account information or regularly transferred the money to his bank, this would have been a non-issue instead of an eight-month headache,” Mark says.

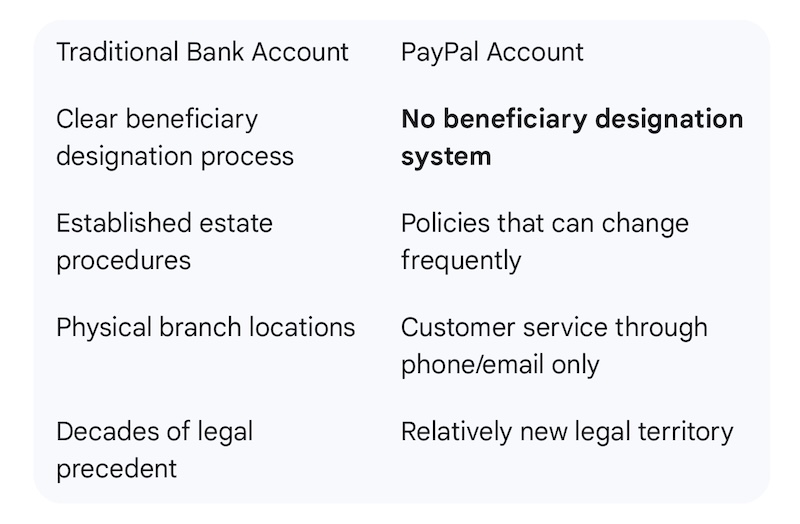

PayPal accounts don’t automatically transfer to family members when someone dies. Unlike bank accounts with clear beneficiary processes, PayPal has specific policies that can freeze funds, complicate access, and create unnecessary stress during an already difficult time.

Here’s what actually happens to PayPal accounts after death, why most families are caught off-guard, and the simple steps your parents can take now to prevent this headache later.

What Happens to PayPal Accounts When Someone Dies?

PayPal’s Official Policy:

Accounts are frozen when PayPal learns of the account holder’s death.

Funds can be released to authorized representatives (with proper documentation).

The process requires death certificates, estate documentation, and verification.

Processing times vary but often take 30-180 days.

No one can simply “log in” and transfer funds legally.

The Hidden Reality:

PayPal often doesn’t know someone died unless the family reports it.

Some accounts remain active for months or years after death.

Automatic payments continue until the funding source is exhausted.

Business accounts face additional complications with pending transactions.

Why This Matters: If your parent sells items online, receives freelance payments, or has accumulated PayPal credit from cashback programs, significant money could be sitting in their account. Unlike traditional bank accounts, this isn’t automatically part of estate planning.

The Documentation Nightmare Most Families Face

What PayPal Typically Requires:

Official death certificate (certified copy).

Proof of your authority to act (letters of administration, executor documentation, or probate court orders).

The deceased’s Social Security number.

Account verification information (which you might not have).

Documentation proving you are the rightful heir or representative.

The Catch-22 Problem:

You need account access to see what’s in there, but you can’t get access without proving the person is dead and that you have legal authority.

PayPal may require information your parent never shared (security questions, linked accounts, transaction history).

If your parent used PayPal infrequently, you might not even know the account exists.

Timeline Reality Check:

Simple cases: 30-60 days minimum

Complex cases: 6 months or longer

Business accounts or disputes: Can exceed one year

Legal fees often required: $200-$2,000 depending on estate complexity

Why PayPal Is Different from Bank Accounts

The Business Account Complication: If your parent used PayPal for any business activity (selling on eBay, freelance work, or casual online transactions) the account might have pending payments, outstanding disputes, connected merchant accounts, or tax implications that complicate estate processing.

The Conversation Your Parent Needs to Have

Most parents don’t realize PayPal funds aren’t automatically part of estate planning. Here’s how to approach this topic:

Start with Discovery: “Do you have a PayPal account? Even if you don’t use it much, there might be money sitting in there from old transactions or cashback rewards.”

Check for Business Activity: “Have you ever sold anything online—eBay, Facebook Marketplace, freelance work? Those payments might have gone through PayPal.”

Explain the Access Problem: “Unlike your bank account, we can’t just bring a death certificate to PayPal and get access. They have a complicated legal process that can take months because there are no beneficiaries.”

Prevention Strategies Your Parent Can Implement Now

Option 1: Regular Account Cleanup (The Gold Standard)

This is the most effective way to prevent any problems. Treat the PayPal account as a pass-through, not a savings account.

The process:

Transfer PayPal funds to a primary, linked bank account monthly or quarterly.

Keep the PayPal balance at zero or a minimal amount.

Cancel any unnecessary services connected to the PayPal account.

Benefits:

Minimizes or eliminates money stuck in PayPal after death.

Makes estate processing infinitely simpler.

Reduces complexity and stress for the family.

Option 2: Create a Digital Asset Inventory

If your parent prefers to keep a balance in PayPal, documentation is the next best thing. This ensures the family knows the account exists and has the necessary information to start the recovery process.

The process:

Create a secure document that lists all digital financial accounts, including PayPal.

Include the account email address, phone number, and any connected bank accounts.

Note whether it’s a Personal or Business account.

List any ongoing subscriptions paid via PayPal.

Benefits:

Ensures the executor of the estate is aware of the asset.

Provides the foundational information needed to file a claim with PayPal.

Prevents funds from becoming permanently lost or “unclaimed property.”

A Note on “Adding a User”: Why It Doesn’t Work You may see advice about adding a family member as an additional user to a PayPal account. This is not a valid solution for personal accounts. The “add a user” feature is for Business Accounts to grant limited permissions to employees. It does not create a co-owner or a beneficiary. Once PayPal is notified of the primary owner’s death, the account will be frozen for all users, and the formal estate process will still be required. Do not rely on this method as a workaround.

Option 3: Business Account Preparation

If your parent uses PayPal for business, more formal planning is necessary.

Document all connected accounts and services (e.g., eBay store, payment gateways).

Create a procedure for handling pending transactions and potential disputes.

Maintain clear records of business vs. personal use for tax purposes.

Incorporate the PayPal business account into a formal business succession plan.

The Documentation Your Family Needs in Your Digital Inventory

Essential Information to Record:

PayPal account email address

Phone number associated with the account

Approximate account balance (check quarterly)

Connected bank accounts or cards

Whether it’s a Personal or Business account

Any ongoing subscriptions or automatic payments

Storage Recommendations:

Store this information securely with other estate planning documents.

Use a password manager that has an emergency access or “digital legacy” feature.

Update the inventory annually or after major financial changes.

Your Action Steps

Ask your parent directly if they have PayPal or other payment accounts.

Review their bank statements for PayPal transfers or payments (with permission) to identify active accounts.

Implement a regular fund transfer routine to keep the PayPal balance at zero.

Create and maintain a digital asset inventory and store it with their will and other estate documents.

Don’t let digital payment accounts become a source of stress during grief. A few minutes of planning today can save your family months of complications tomorrow.

For complete digital asset planning:

Visit DigitalLegacyKit.com for comprehensive guides covering all payment platforms, family conversation scripts, and estate coordination tools. PayPal is just one piece of the digital financial puzzle that families need to address.

Don’t let digital payment accounts become a source of stress during grief. A few minutes of planning today can save your family months of complications tomorrow.

PayPal policies change frequently and vary by account type and region. This information reflects general policies as of September 2025—always verify current procedures with PayPal directly.